Under the provision the maximum refundable amount per child would rise to 1800 in 2023 1900 in 2024 and 2000 in 2025 How many kids would benefit from the CTC changes. According to the framework the maximum refundable portion of Child Tax Credit would increase from the current level of 1600 per child to 1800 in tax year 2023 1900 in tax year. In the first year the familys Child Tax Credit would increase by 1725 from 1875 to 3600 Half of the roughly 16 million children who would benefit under the proposal in the first. More families could be eligible for the child tax credit as soon as 2024 if new legislation passes Congress IStock Congressional negotiators announced a roughly 80 billion deal. A bipartisan group of lawmakers released a roughly 78 billion tax package Tuesday that would enhance the child tax credit and restore several business tax breaks as well as boost..

Dla Your Top 5 Questions Answered

Learn how to claim Child Tax Credit if you already get Working Tax Credit or apply for Universal Credit or Pension Credit..

. . File your taxes to get your full Child Tax. The Child Tax Credit program can. ..

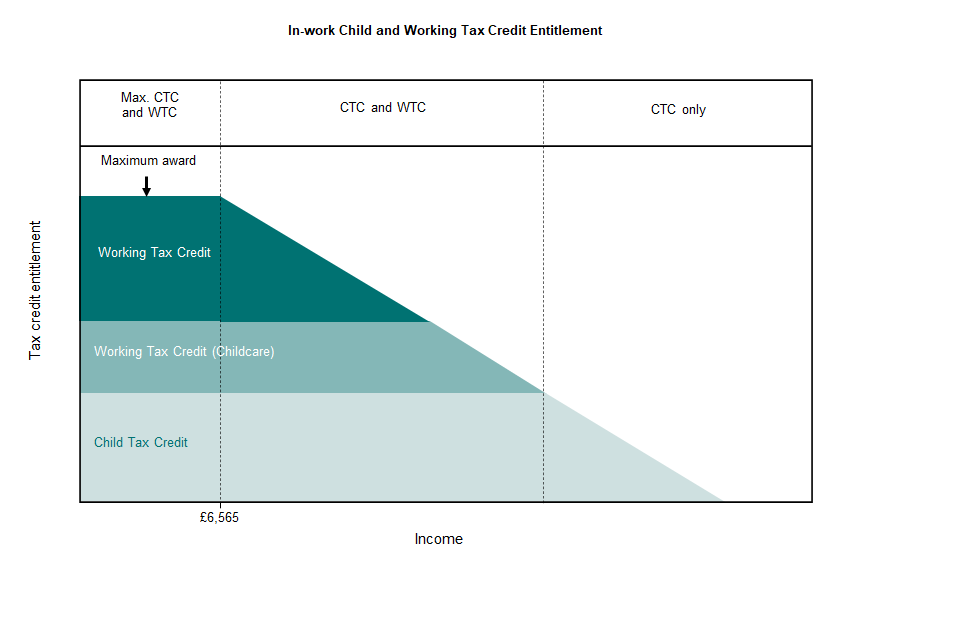

Background And Definitions Child And Working Tax Credits Statistics Provisional Awards April 2022 Gov Uk

The child tax credit may expand in 2024 Heres what it means for you The changes agreed to by negotiators would primarily benefit. Ron Wyden D Ore and Rep Jason Smith R Mo said the plan includes a phased increase to the refundable portion of the child tax. The cap was previously 1600 and would increase to 1800 in 2023 1900 in 2024 and so forth Families who are eligible for this credit. The new child tax credit policy would benefit about 16 million kids in low-income families according to an analysis by the liberal-leaning Center. Under the bill it would lift the amount to 1800 in tax year 2023 1900 in tax year 2024 and 2000 in tax year 2025 and begin adjusting for inflation..

Comments